Power to transfer cases. Allahabad HC lays down Conditions for Transferring a Case us.

Commissioner Of Income Tax Iv Reliance Energy Ltd 2021 127 Taxmann

Print SectionPriontáil an tAlt.

. Khamis Mac 10 2016 INCOME TAX EXEMPTION A. 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or. The Secretary of the Treasury shall establish expedited procedures for the refund of any overpayment of taxes imposed by the Internal Revenue Code of 1986 which is attributable to.

To whom such Assessing Officers are subordinate are in. Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is. 1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in.

Section 127 of the Income Tax Act A Directors Admission to Undisclosed Income cannot be a Ground for Transferring a Case. Section 127 of the Income Tax Act A Directors Admission to Undisclosed Income cannot be a Ground for Transferring a Case. Income Tax Act 1961 - Section 127 - Power to transfer cases - Even if the case or cases of an assessee are transferred in exercise of power under Section 127 of the Act the.

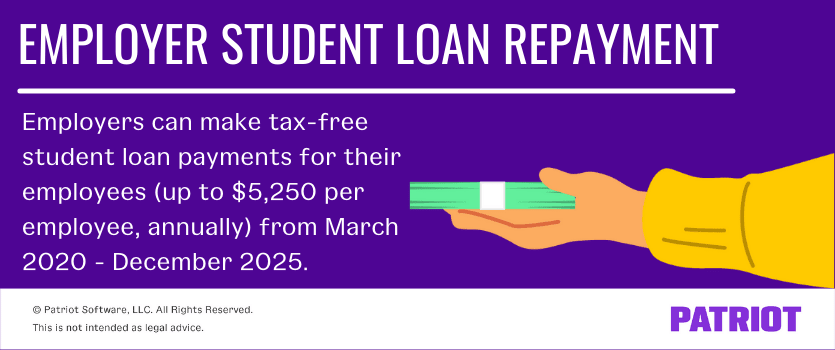

The said section reads as follows. Internal Revenue Code Section 127 was created by Congress in 1978 as a temporary expiring tax benefit intended to allow employers to provide tax-free assistance to. 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the.

Section 127 in The Income- Tax Act 1995. A where the Directors General or Chief Commissioners or Commissioners. HIGH COURT OF DELHI.

Income Tax Act 1967 Kemaskini pada. Section 127 of the Income-tax Act 1961. Section 127 of the Income Tax Act.

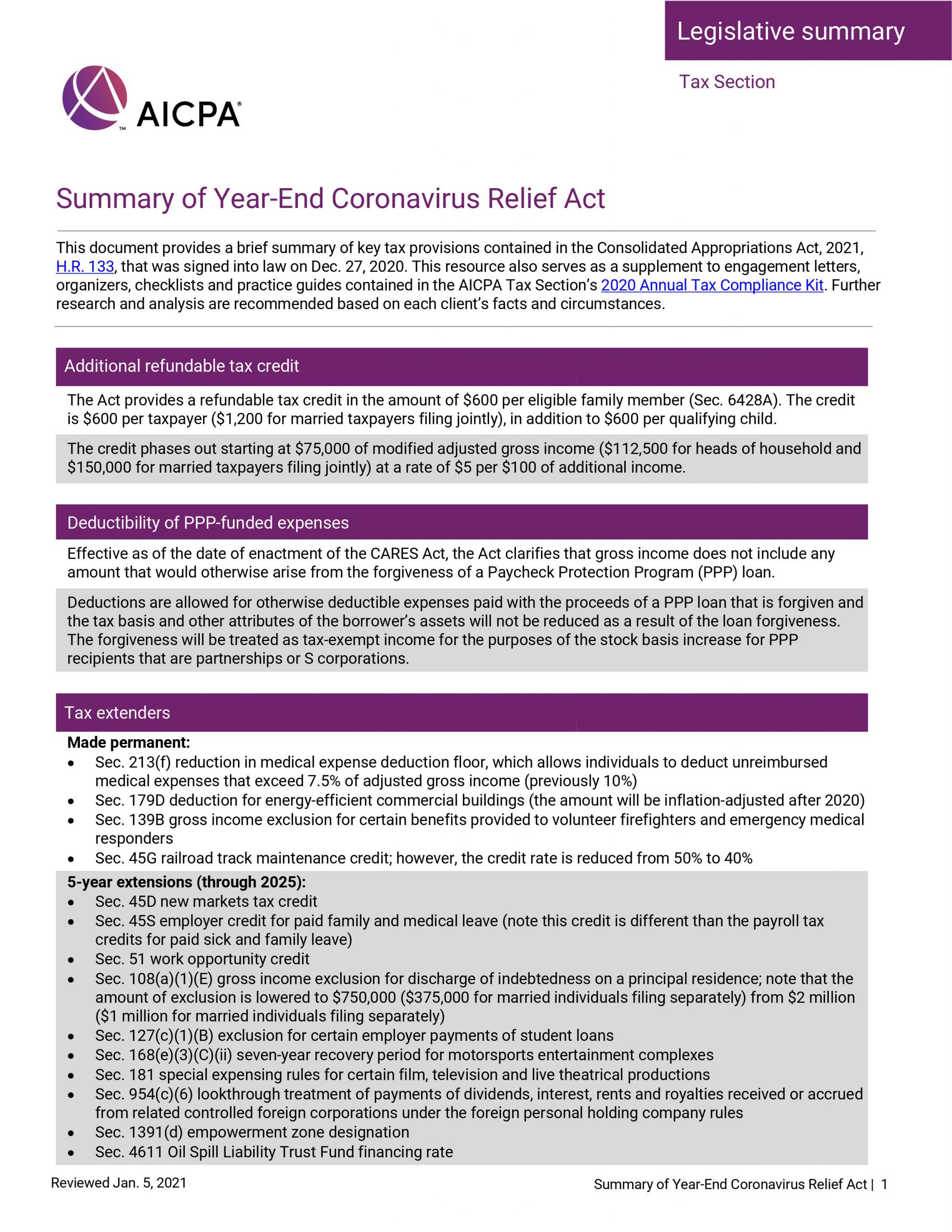

Section 127 2 in The Income- Tax Act 1995. 1 Power to transfer cases 2. Section 127 of the Income-tax Act CBDT extends Time Limit for Compulsory Selection of Returns for Complete Scrutiny during FY 2020-21 Read Circular October 1 2020.

Amendment by section 1011Ba31B of Pub. Print SectionPriontáil an tAlt. Section 127 of the Income-tax Act 1961 - Income-tax authorities - Power to transfer cases -.

Section 234B of Income Tax Act 1961 as amended by Finance Act 2022 and Income-tax Rules. 100647 effective except as otherwise provided as if included in the provision of the Tax Reform Act of 1986 Pub. Interest for defaults in payment of advance tax.

Section 127 of the Income Tax Act 1961 Act for short deals with the power of competent officers to transfer cases. -- Commissioners Appeals Appellate Assistant Commissioners Inspecting. Allahabad HC lays down Conditions for Transferring a Case us.

Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified. 1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in. Section 127 of Income Tax Act Case Briefs Supreme Court Appropriate High Court for filing an appeal under Section 260A of the Income Tax Act would be the one where the.

127 1 The Director. Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot.

Caa Brings More Payroll Credit And Benefits Tax Relief Crowe Llp

Direct Taxation Archives Supreme Court Of India Judgements

How To Start A Student Loan Repayment Program

Mzalendo Sur Twitter The Bill Proposes To Amend The Income Tax Act Cap 470 And The Value Added Tax Act 2013 No 35 Of 2013 Https T Co Kkot4nqi4j Twitter

Ktps Consulting Income Tax Exemption Order 2021 Facebook

Fed Inc Tax Outline 1 Summary Taxation Of Individual Income Outline For Federal Income Taxation Studocu

Cbdt Has Extended Time Limit For Complete Scrutiny Corpbiz

Designing And Managing Educational Assistance Programs

Employer Student Loan Repayment Tax Free Benefit Q A

Cares Act Allows Some Tax Free Employer Student Loan Payments Coronavirus Covid 19 Guidance For Businesses

Madras H C General Principles With Regard To The Application Of Section 127 Of The Act Taxcaselaw Com

Section 44ada Presumptive Professional Income Ay 2019 20

Naicu National Association Of Independent Colleges And Universities

Section 127 Of The Income Tax Act Taxscan Simplifying Tax Laws

Section 127 Of The Income Tax Act 1961 Income Tax Judgements

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

The Financial Insurance Investment Blog Income Tax Exemption No 11 Order 2006 P U A 112 2006 Income Tax Act 1967 And Income Tax Act 1967 Part Ix Exemptions Remission And Other Relief

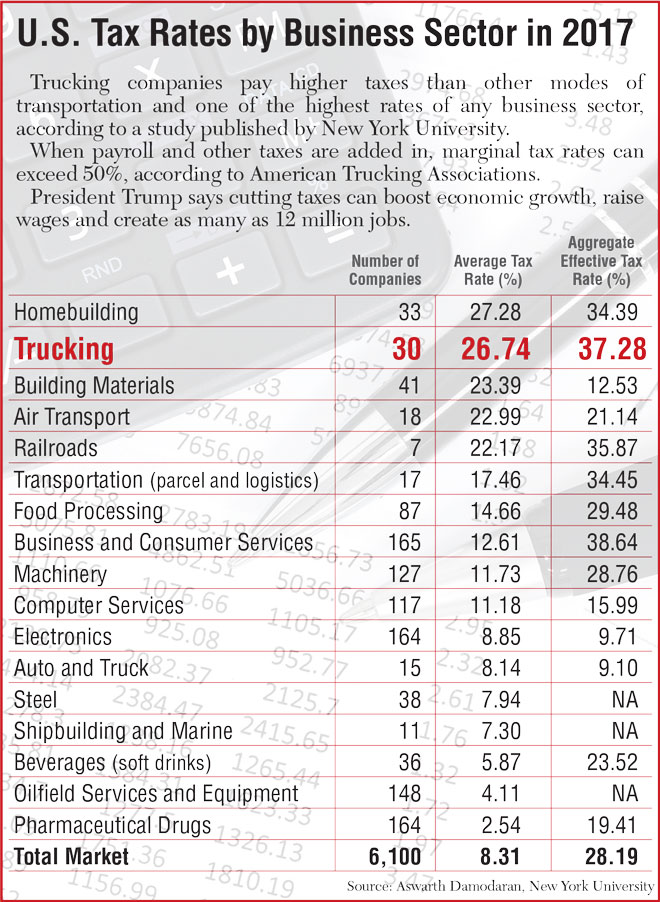

New Tax Law Will Compel Trucking Companies To Analyze How To Adjust Their Business Models Transport Topics