Tax incentives have been useful to a certain extent in the past to attract foreign direct investments into Malaysia. To increase the disposable income of the middle-income group and to address the rising cost of living in Malaysia the budget proposes to cut individual income tax rates by two.

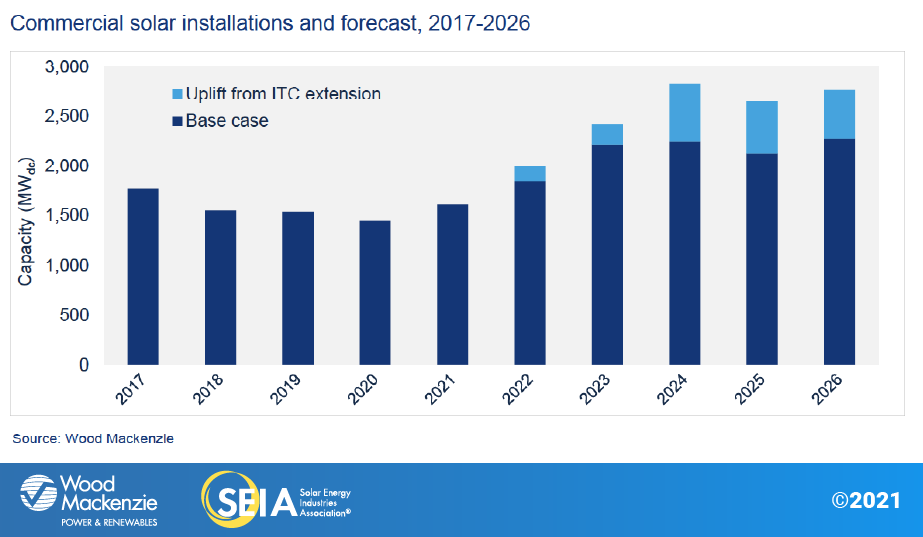

Solar Market Insight Report 2021 Q4 Seia

In Budget 2018 to encourage venture capital activities the Government proposed the following extension and updates to the previous venture capital incentives in Malaysia see.

. In addition to waiving certain fees for a 12-month period and providing wage subsidies for a three-month period the PEMERKASA package focuses on 20 strategic. Malaysia government imposed an income tax on financial income generated by all entities within their. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well.

In Malaysia the corporate tax rate is now capped at 25. 10 tax rate for up to ten years for existing. Tax Incentives by Legislation.

These incentives include investment tax allowances for example a 60 or 100 allowance on capital investment made up to ten years double deductions reinvestment. Free Zone Act 1990 Customs Act 1967. In addition for companies that are already.

Pioneer status PS and investment tax allowance ITA The PS incentive involves a tax exemption for 70 of. MALAYSIA has a wide variety of incentives which include. The other existing tax incentives which are also under review by the relevant authorities in Malaysia eg principal hub pioneer status etc.

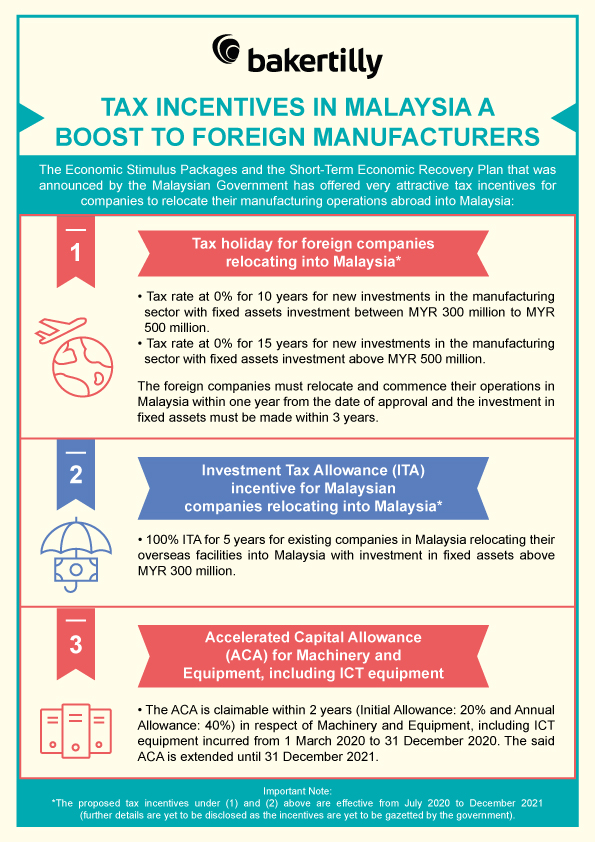

Tax Incentives in Malaysia A. 0 to 10 tax rate for up to ten years for new companies that relocate their services facility or establish new services in Malaysia. Customs Act 1967 Sales Tax Act 1972 Excise.

Tax Incentive for Bond and Sukuk In Malaysia Jan 29 2018. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. Generally tax incentives are available for tax resident companies.

Manufacturing Services Trading Sector. Assessment YA 2018 to 2020 fully claimable within two years of assessment. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

12 rows To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals. Companies that have generally started production less than a year and fall. In the past year the Malaysian Government had introduced various tax incentives to businesses ranging from exemptions additional deductions and reliefs through economic.

Labuan Offshore Business Activity Act LOBATA 1990. Non-resident companies are taxed at 24 from 2016 25 for 2015 but they are exempted of taxes on dividends taxed at 15 on interests and 10 on royalties rental of. Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 75 with.

In Budget 2018 to encourage venture capital activities the Government proposed the following extension and updates to the previous venture capital incentives in Malaysia see Special Tax.

Gst Vs Sst In Malaysia Mypf My

What The 2018 Tax Brackets Standard Deductions And More Look Like Under Tax Reform

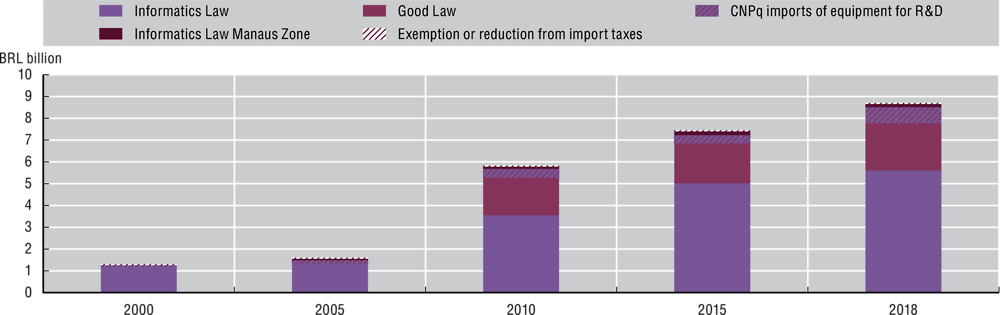

Unleashing Digital Innovation Going Digital In Brazil Oecd Ilibrary

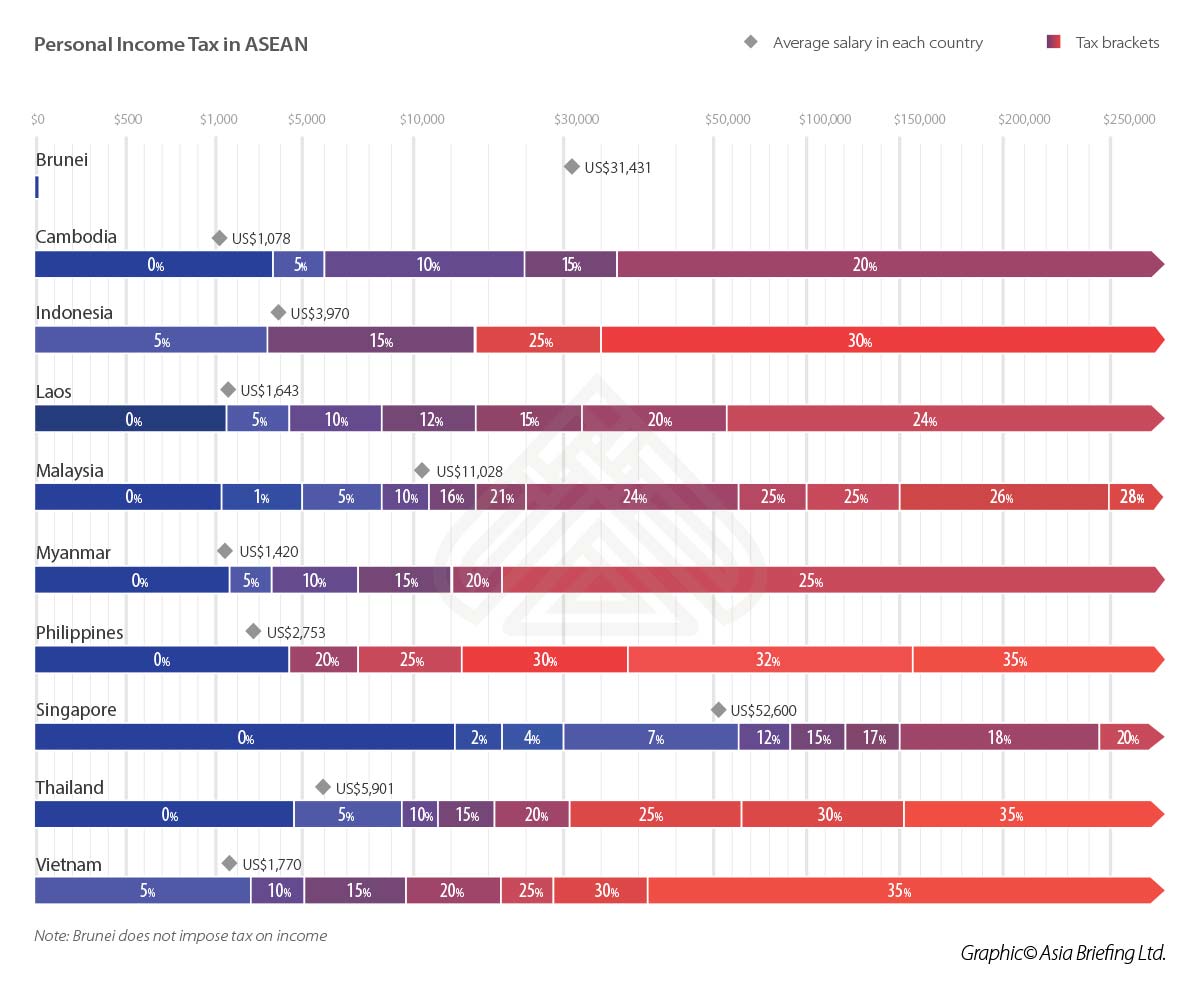

Comparing Tax Rates Across Asean Asean Business News

Why It Matters In Paying Taxes Doing Business World Bank Group

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

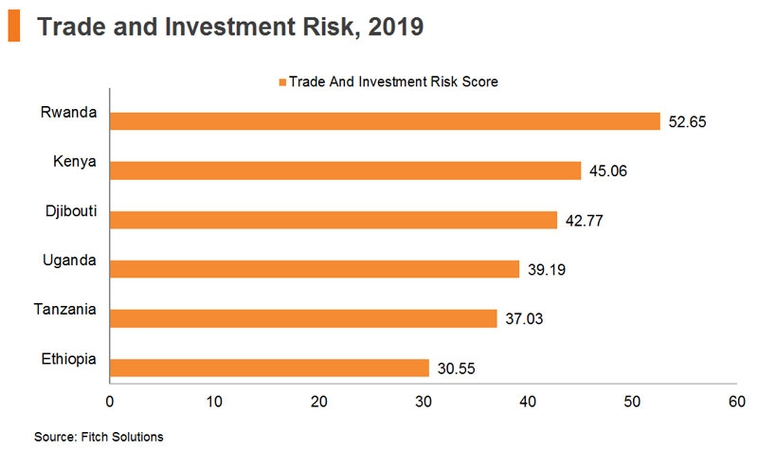

Section 4 Regulations Tax Incentives In Ethiopia Hktdc Research

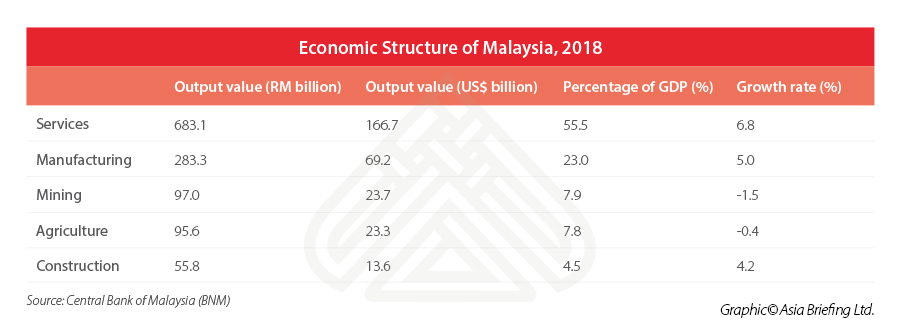

China 1 Series Understanding Malaysia S Appeal To Foreign Investors

Solar Surge Follows Decade Of Import Duty Support Uncertainty S P Global Market Intelligence

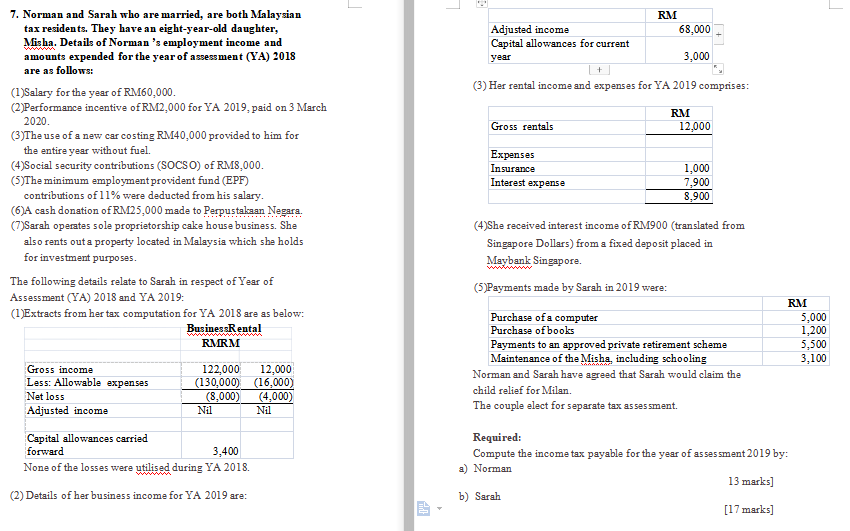

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

Tax Incentives In Malaysia A Boost To Foreign Manufacturers Baker Tilly Malaysia

Corporate Tax Rates Around The World Tax Foundation

Comparing Tax Rates Across Asean Asean Business News

Solarplaza Top 25 Solar Plants Southeast Asia

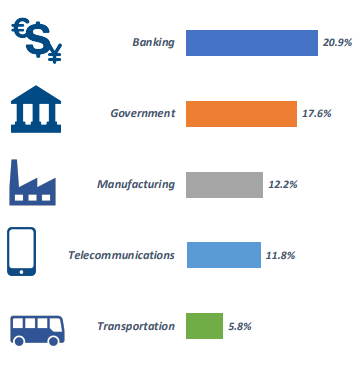

Malaysia Information Communications Technology

7 Flat Tax On Foreign Income Studio Legale Metta